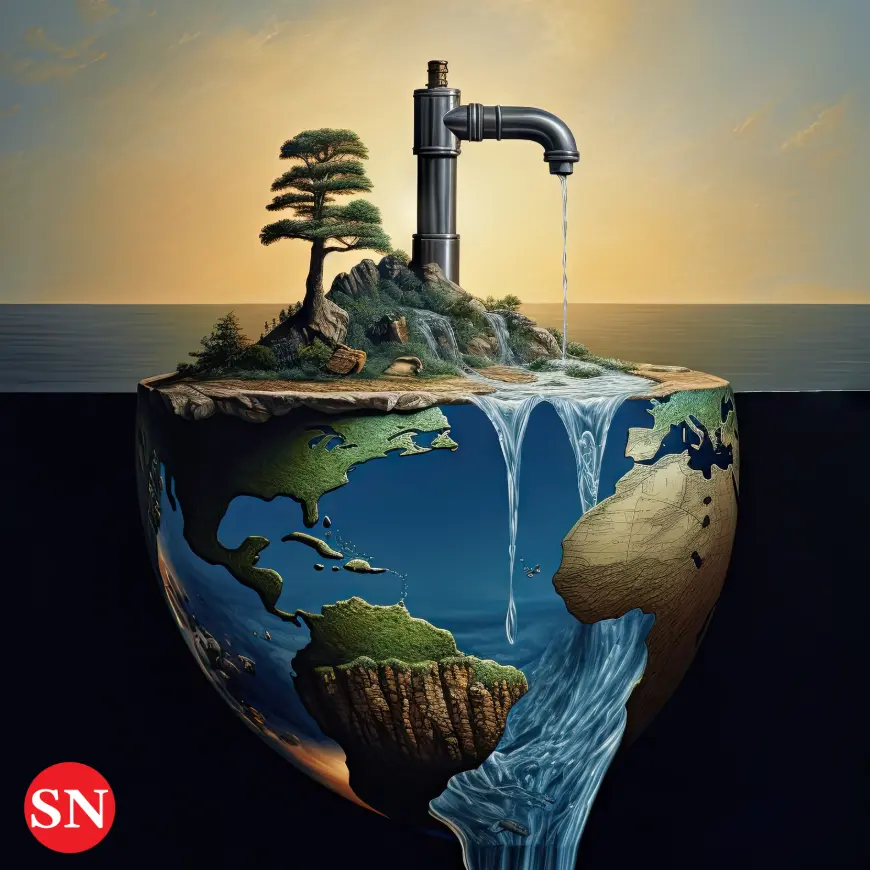

GURUGRAM — As we move through 2026, a new term has entered the lexicon of global risk assessment: “Water Bankruptcy.” Unlike traditional fiscal insolvency, water bankruptcy occurs when a nation’s renewable water debt exceeds its natural “income,” leading to a total collapse of industrial, agricultural, and urban supply chains.

At Storify News, we have analyzed recent data from global hydrologists and economic forecasters to identify the emerging economies currently standing on the precipice of this liquidity crisis.

What is Water Bankruptcy?

Water bankruptcy is not merely a “drought.” It is a structural failure where the extraction of groundwater and the pollution of surface water outpace the natural recharge rate so severely that the “capital” (aquifers) is permanently depleted. In 2026, this has shifted from an environmental concern to a sovereign credit risk.

The “At-Risk” Economies of 2026

1. The North African Corridor (Egypt & Morocco)

Egypt is facing a historic “water deficit” as the Grand Ethiopian Renaissance Dam (GERD) alters Nile flow dynamics. With a population exceeding 110 million, Egypt’s agricultural sector—the backbone of its economy—is struggling with rising salinity and diminishing yields. Morocco, meanwhile, is experiencing its eighth consecutive year of record-breaking heat, forcing the government to prioritize “drinking water over irrigation,” a move that threatens its status as a leading exporter to the EU.

2. South Asia: The Indus-Ganges Stress Test

India and Pakistan remain the world’s most groundwater-dependent nations. In 2026, the depletion of the Indo-Gangetic aquifer has reached a tipping point. While India’s Jal Jeevan Mission has made strides in rural connectivity, the industrial hubs of North India are facing “Day Zero” scenarios that threaten to stall manufacturing growth.

3. South Africa: Beyond Cape Town

The crisis that once famously hit Cape Town has now moved to the industrial heartland of Gauteng. Johannesburg and Pretoria are grappling with aging infrastructure and shifting rainfall patterns, leading to “water-shifting”—a practice similar to load-shedding for electricity. This instability is deterring foreign direct investment (FDI) in the nation’s mining and manufacturing sectors.

The Economic Ripple Effect

Water bankruptcy triggers a domino effect that impacts global markets:

- Food Inflation: As irrigation fails, emerging markets are forced to import staples, draining foreign exchange reserves.

- Energy Insecurity: Hydroelectric power accounts for a massive portion of the energy mix in developing nations. Low water levels lead to blackouts, as seen in the Zambezi basin.

- Manufacturing Stalls: Data centers, semiconductor plants, and textile mills require immense water volumes. In 2026, companies are increasingly moving operations based on “Hydrological Sovereignty.”

The Path to “Hydrological Solvency”

Solving water bankruptcy requires a shift from “supply-side” management to “circular” water economies.

- Desalination 2.0: Moving beyond energy-intensive plants to solar-powered modular desalination.

- Wastewater Mining: Treating urban sewage as a resource for industrial cooling and agriculture.

- Regenerative Agriculture: Shifting to crops that require 40% less water while maintaining caloric output.

The Bottom Line

In 2026, a nation’s GDP is only as strong as its water table. For investors and policymakers, the “water balance sheet” is now just as important as the fiscal one. Storify News will continue to track these hydrological trends as they redefine the geopolitical map of the late 2020s.